Why Bragg Has a Strong Felony Case Against Trump

Despite the Skeptics, Bragg's case in New York is Quite Strong

Alvin Bragg, the Manhattan District Attorney, has faced tremendous scrutiny due to his ongoing effort to build a case against former president Donald Trump. The prospective charges are being devised using an inventive legal approach. Surprisingly, the disapproval comes from not just Trump's supporters, but also from individuals who typically oppose him, expressing concerns about the case's potential lack of strength.

The criminal case is centered on 11 counts of fraudulent invoices, 11 counts of fake checks and check stubs, and 12 counts of falsified general ledger entries. These would all be misdemeanors, however, if they are done in order to commit a larger felony crime, each of these counts would be considered a felony themselves. This is exactly what Bragg is going after, as one can see from the Statement of Facts that were released yesterday.

This document mentions specific transactions made for Ms. Daniels and Karen McDougal, involving The National Enquirer, which shared long-standing connections with the former president. These transactions allegedly aimed to bolster his chances of securing the presidency. If substantiated, these deals would represent attempts to breach both state and federal election laws, as articulated by Mr. Bragg. These laws cover aspects like the sum and disclosure of certain transactions. By this rationale, the alleged campaign finance violations were concealed by the false records within the article's 34-count indictment.

Surprisingly, both the right and the left seem to be making a similar argument that the case brought by Alvin Bragg, is tenuous and lacks the necessary fortitude to result in a felony conviction. However, much of this skepticism stems not from a lack of evidence - since the entirety of the evidence has not yet been disclosed - but from Bragg's failure to explicitly specify the underlying felony in question. As previously suggested, the potential felony is most likely related to the alleged attempts to breach state and federal campaign finance laws, an issue that is not unfamiliar to New York's judicial system.

In fact, the Karen Friedman Agnifilo and Norman Eisen from the New York Times specifically cite numerous cases in which this strategy has been used before by New York Prosecutors and has resulted in convictions:

For example, the Rockland County D.A. convicted the executive Richard Brega for falsifying business records by misrepresenting the source of funds that he funneled into a campaign. The Oneida County D.A. charged a county political party chair, John Dote, with pilfering campaign funds and failing to properly account for them, resulting in conviction for felony falsification of business records (and second-degree grand larceny). The Brooklyn D.A. convicted Assemblyman Clarence Norman for soliciting illegal campaign contributions and for felony falsification of business records. And on and on, in New York and federally.

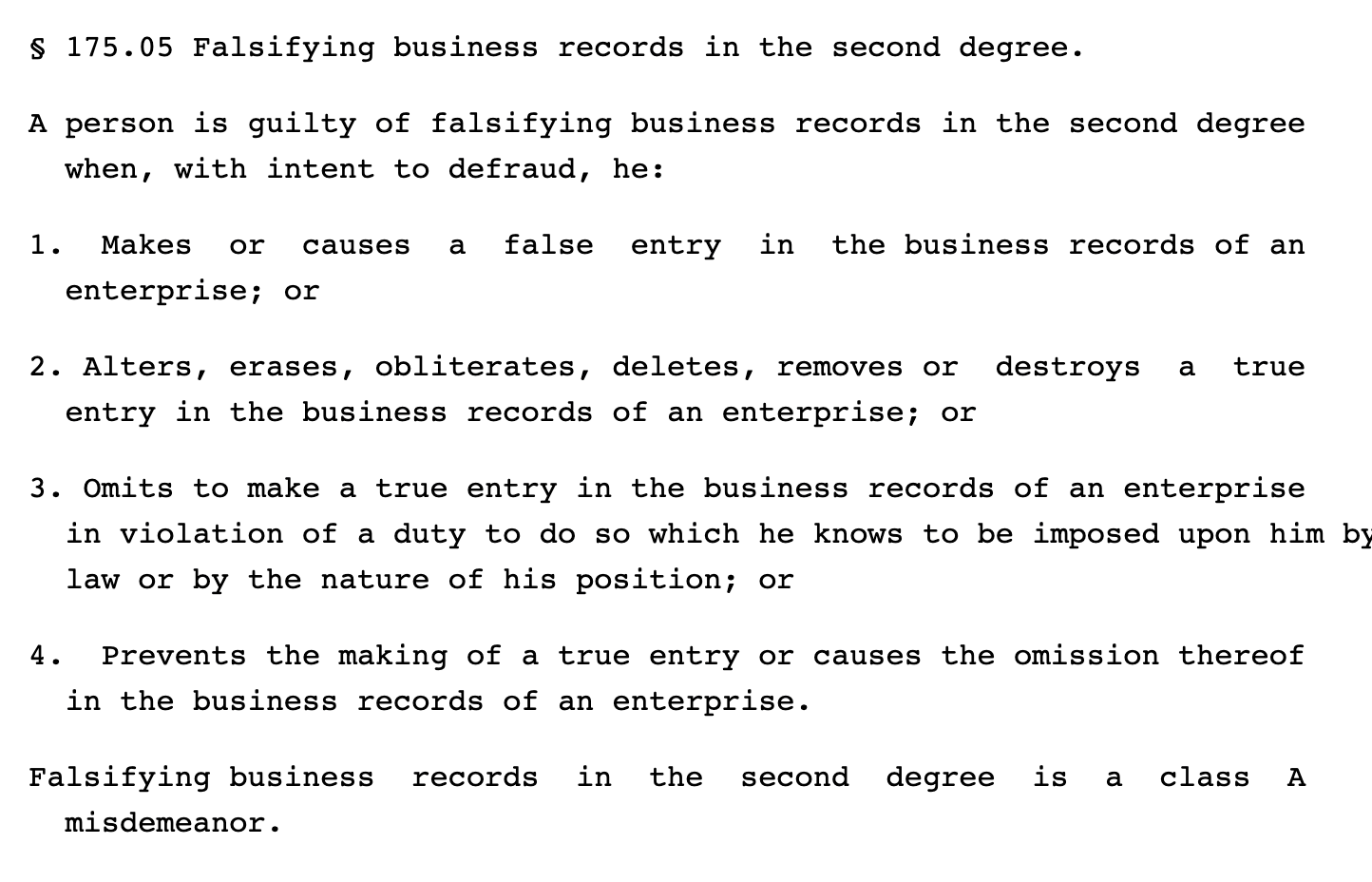

So let's rewind a bit. The underlying crimes would be the 34 counts of 'Falsifying Business Records in the Second Degree'. This statute would require the following:

These crimes can all then escalate to a felony if the person accused had “intent to commit another crime or to aid or conceal the commission thereof,” meaning that they aimed to deceive and simultaneously had the purpose of committing an additional crime, or providing assistance or cover for its execution.

A key aspect of both misdemeanor and felony accusations is that the individual must have acted with the "intent to defraud". This is what has many legal analysts a bit concerned over Bragg's burden of proof that he will be required to show for a felony conviction. But, there is a big BUT!

While "intent to defraud" is viewed on the federal level, one way, it is actually viewed in a much broader sense in New York State. While other jurisdictions view the phrase as pertaining to a defendant who deprives another person of property or a thing of value, New York State actually applies to defendants who acted “for the purpose of frustrating the state’s power” to “faithfully carry out its own law.”

New York State's case against Trump revolves around allegations that he falsified business records to conceal violations of campaign finance laws at both the federal and state levels. This would certainly open the door for prosecutors to go after Trump on the felony charge, as the hush money payments would likely have prevented the State from executing their elections in a free and fair way. The same could also apply on the federal level.

While the state prosecution team may face the challenge of explaining complex legal terminology to a jury, it is worth noting that New York is widely recognized as the financial epicenter of the globe. Prosecutors in the state are thus experienced in effectively communicating intricate legal concepts to juries on a regular basis.

Although it may be contended that establishing the case as a felony could present a greater challenge, and that Trump may have the ability to overcome the charges in court, it is indisputable that a valid case exists.

Umm - I was told I was already set up after I paid my $50 last week. If I have to sign in every time single time and check my email - heck, I could’ve read all the news. Then please just refund my money and I’ll be on my way.